Calculating the 1% rule is simple. Just multiply the purchase price of the property by 1%. Even easier, move the comma in the purchase price to the left two spaces. The result should be the minimum you charge in monthly rent.

If the property requires any repairs, you’ll also want to factor them into the equation by adding them to the purchase price, then multiplying the total by 1%.

Examples Of The 1% Rule For Investing

Here’s an example for a home with the purchase price of $150,000:

$150,000 x 0.01 = $1,500

Using the 1% rule, you should find a mortgage that has a monthly payment of $1,500 or less and charge your tenants a minimum monthly rent of $1,500.

Let’s say the home required about $10,000 worth of repairs. In this situation, you would add the cost of repairs to the purchase price of the home, for a total of $160,000. Then, you’d multiply that total by 1% to get a minimum monthly payment of $1,600.

An Investment Property That Passes The 1% Rule

Maybe you’re looking to purchase an investment property that’s listed for $200,000 and has historically charged $2,500 for monthly rent. Per the 1% rule, the monthly rent should be equal to or greater than $2,000 per month. Since this property charges $2,500 per month, it passes the 1% rule.

An Investment Property That Does Not Pass The 1% Rule

Let’s say the same property, listed for $200,000, has historically charged $1,800 for monthly rent. This property wouldn’t pass the 1% rule because the monthly rent is less than $2,000 (or 1% of the purchase price).

In this case, you would continue your search for a more profitable rental property or make an offer of no more than $180,000 to purchase the home.

The 1% Rule And Other Investment Rules In Real Estate

When it comes to real estate investing, the 1% rule isn’t the only method used for determining the best opportunities to buy a rental house. Other popular methods include the gross rent multiplier, the 70% rule and the 2% rule.

Gross Rent Multiplier

The gross rent multiplier (GRM) gauges the amount of time to pay off the investment. It’s the purchase price divided by the gross annual rent. The total you get is the number of years it will take to pay off the investment using just your rental income. The lower the GRM, the more lucrative the property may be.

For example, you purchase an investment property for $200,000. You charge $2,500 per month for rent. Your annual gross rental income is $30,000 (2,500 x 12). $200,000/$30,000 = 6.67.

The GRM of this property is 6.67, meaning it will take about 6.67 years to pay off the property using your gross rental income. Of course, you’ll need to consider other expenses when determining a property’s profit potential. These include repair costs, operating costs, maintenance and vacancy rate.

You can use the GRM to compare different investment properties, too. If one property has a GRM of 6.67, while another has a GRM of 8.33, the one with the lower GRM (6.67) may be the better option since you’ll pay off the investment faster. When comparing properties, make sure they are in similar markets and have similar operating, maintenance and other costs.

70% Rule

The 70% rule is for those looking to flip a house, and it states that the investor should pay no more than 70% of the home’s after repair value (ARV), minus any repair costs.

To calculate the 70% rule, simply take the estimated ARV of the home and multiply it by 0.7 (or, 70%). Once you have the total, subtract any estimated repair costs. This will be the amount you should pay for the property.

Here’s an example: You are interested in a property that you estimate will have an ARV of $150,000. You estimate that you’ll need to spend about $30,000 on repairs in order to flip the home. $150,000 X 0.7 = $105,000 so $105,000 is the maximum amount you should spend on purchasing the home and making the repairs. $105,000 – $30,000 (repair cost) = $75,000.

Per the 70% rule, you should pay no more than $75,000 for the property.

2% Rule

The 2% rule is the same as the 1% rule – it just uses a different number. The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price.

Here’s an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000. Using the 2% rule, you should find a mortgage that has a monthly payment of $3,000 or less and charge your tenants a minimum monthly rent of $3,000.

As you can see, the 2% rule is more extreme than the 1% (basically doubling the monthly rent), but it can work in certain markets and provide a financial safety net if you have difficulty filling vacancies or need a major, costly repair on the property.

No matter which rule you decide to go with, it’s important to run the numbers on a potential property to make sure you’re making an affordable investment.

Get approved to see what you can afford.

Rocket Mortgage® lets you do it all online.

Start My Approval

When The 1% Rule Works

The 1% rule is a good prescreening tool. It works well as a guide for determining a good investment from a bad one and narrowing down your choices of properties. As you review listings, apply the 1% rule to the listing price and then see if what you get is close to the median rent for the area. If the median rent for the area is way below 1% of the listing, you may want to remove that property from your list of options.

When The 1% Rule Doesn’t Work

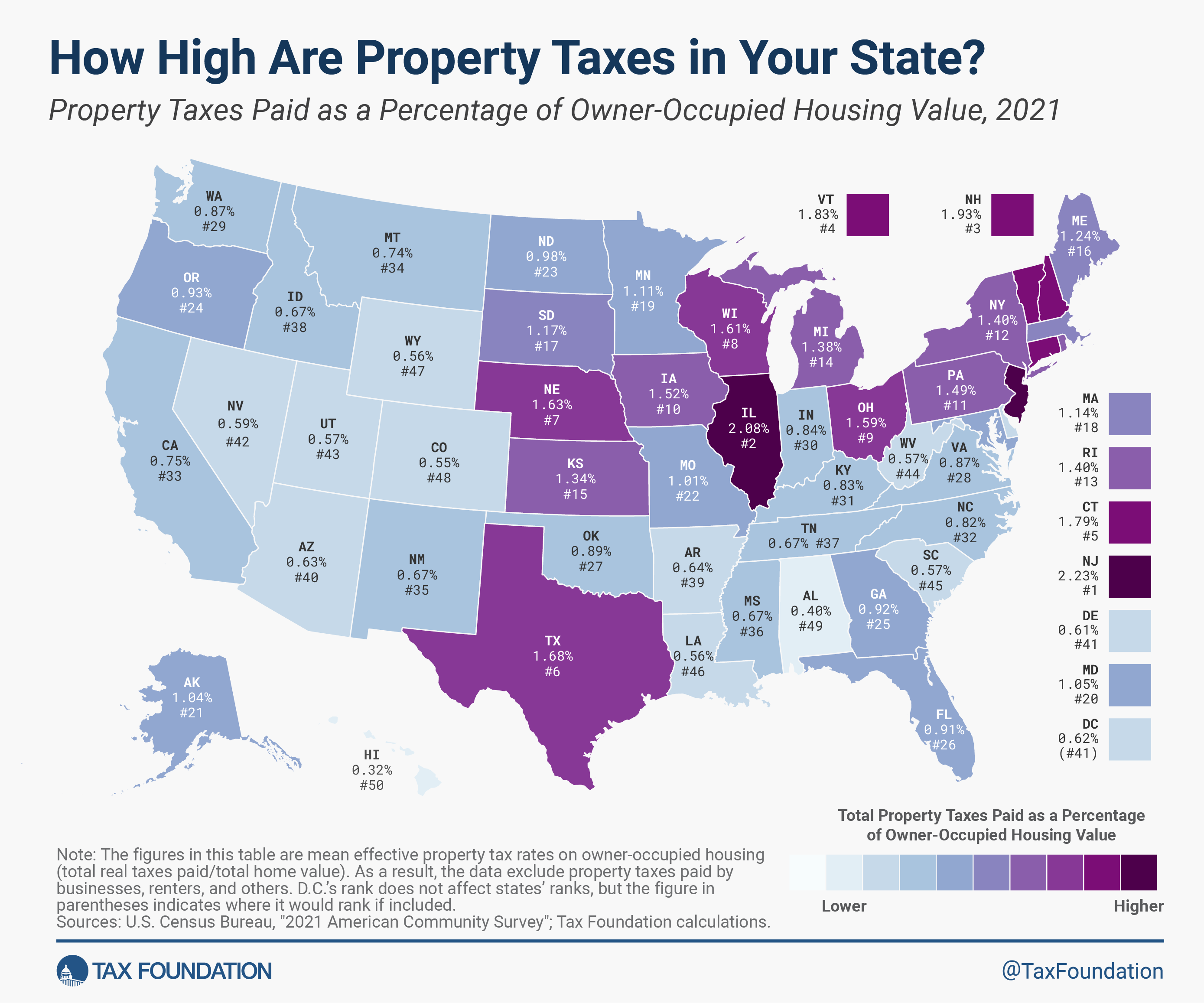

As already mentioned, the 1% rule has limitations. It’s best to only use the calculation as a rule of thumb, because it doesn’t consider costs like maintenance, property taxes, insurance and operating expenses.

You’ll also want to be aware of the problems that may arise with purchasing an investment property in the most expensive cities, where it may be more expensive to buy a home but the average rent for the area is lower than 1% of the purchase price. For example, the median list price in San Francisco is about $1,290,629. Using the 1% rule, you should charge a minimum monthly rent of $12,906. However, the median rent in San Francisco is close to $3,000 per month. To match the 1% rule to the median rent in San Francisco, you’d have to find a property listed for about $300,000 – almost a quarter of the median list price for the city.

Factors To Consider Beyond The 1% Real Estate Rule

When trying to calculate the profitability of an investment property, especially a property located in one of the best places to invest in real estate, other factors are also worth considering. One is the net operating income, which is the profit you make on the property after subtracting the operating expenses. This formula takes into account those factors listed above that the 1% rule does not. You’ll also want to think about the internal rate of return (IRR), which compares the future value of the property to what it’s worth today.

The Bottom Line: Know The Rules Of Investment Properties

When considering an investment property, it’s important to not be in the dark on how large of a return on investment the home can provide. In other words, it’s essential to know what you’re getting into before purchasing a property. Now that you have a few strategies for making that decision, it may be time to start your real estate investment journey.

Get approved with Rocket Mortgage® today to find the best financing solution for your real estate investment goals.

Get approved to see what you can afford.

Rocket Mortgage® lets you do it all online.

Start My Approval

You must be logged in to post a comment.